Zero rated/exempt delivery rates and products

Supplies of certain products, services or delivery charges do not attract VAT. They are therefore either zero rated or exempt for VAT purposes.

Please note, ShopWired does not distinguish between the two terms of zero rated or exempt taxable supplies.

If your account is VAT registered you can specify when creating/editing a product or delivery rate if it has an effective 0% rate of VAT.

Products

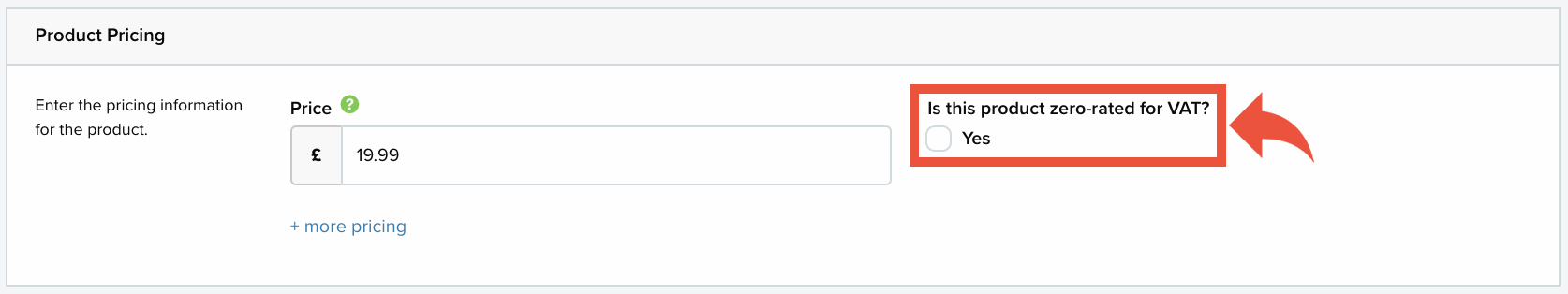

You can set a product as zero rated for VAT in the ‘Product Pricing’ section when creating/editing the product. Use the tick box under ‘Is this product zero-rated for VAT?’ to determine if the product is zero rated:

Placing a tick in the box sets the product with an effective 0% VAT rate, therefore marking it as zero rated/exempt. If the product has any variations, choices or product extras they will also be treated as having a 0% VAT rate.

If you have activated the custom VAT features extension place a tick in the box by 'zero' to make the product zero rated:

Delivery rates

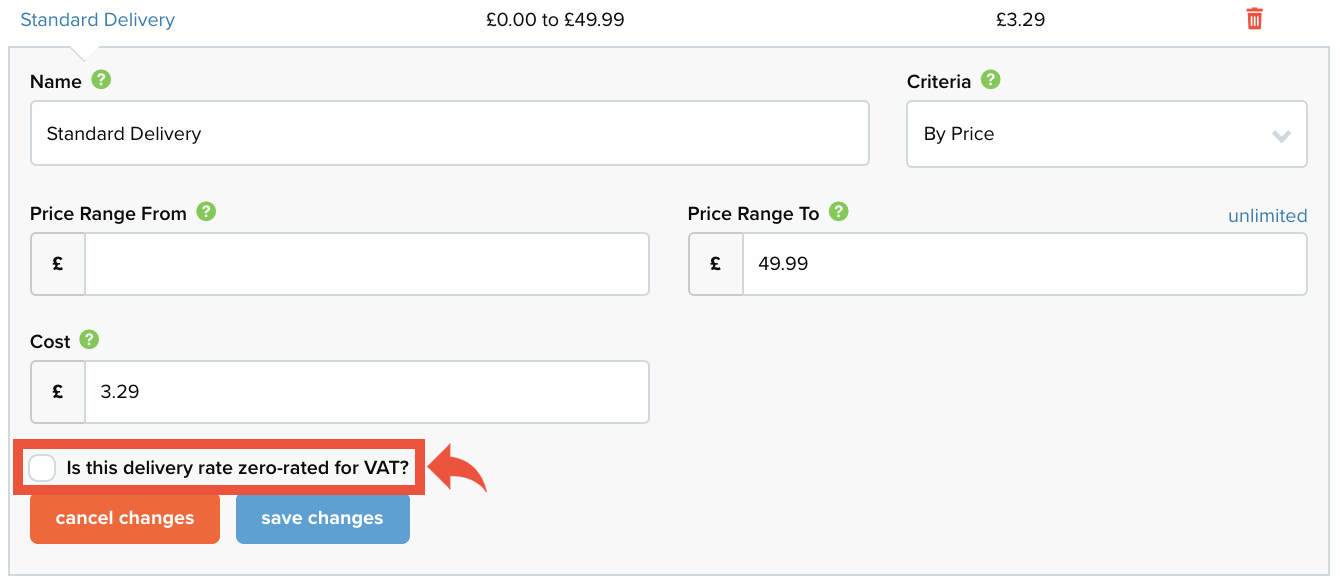

You can determine if a delivery rate is zero rated when creating/editing it. Use the tick box beside ‘Is this delivery rate zero-rated for VAT?’ to determine if the delivery rate is zero rated:

If you tick this box, the delivery rate will be set with an effective 0% VAT rate and will not attract any VAT.