Configuring your VAT settings

If your business is VAT registered you can alter your settings to have the platform account for VAT for all products and delivery rates on your website.

Select from the menu to set your site as VAT registered and also configure the rest of your VAT settings. Below is an explanation of each setting.

Important!

Changing your VAT settings will impact your product and delivery prices.

• Changing your VAT registration status

• Do prices contain VAT

• Using the default VAT rate

• Displaying prices on your website including/excluding VAT

• Charging the full VAT equivalent price in non-VAT zones

• Google feed and VAT

Changing your VAT registration status

To set your website as VAT registered change the selection to Yes under ‘Are you VAT registered?’:

Important!

After changing this setting please check the prices on your website as you might need to adjust the pricing of your products.

Here is an explanation of what happens to your product and delivery rate pricings when you alter this setting:

Changing from not VAT registered to VAT registered

If your account is currently set as not VAT registered and you are going to change it to VAT registered you will also need to set whether or not your current prices include VAT.

If you set that your products’ prices include VAT (and the system should therefore not add VAT when displaying the prices on your website) then 20% will be added to the previously entered price in the admin system. For example, if a product cost £100 before you made the change, it will now cost £120. The price of the product in the admin system (when creating/editing a product) will now be displayed to you as £120.

If you set that your products’ prices don’t include VAT (and the system should therefore add VAT when displaying prices on your website) then the system will add 20% to the price of the product when it displays on your website, but it will display the same price it did before in the admin system. For example, if a product cost £100 before you made the change, it will now cost £120. The price of the product in the admin system (when creating/editing a product) will be displayed to you as £100 but will display on the website as £120.

Changing from VAT registered to not VAT registered

If your account is currently set to VAT registered and you want to change to not VAT registered and your prices were entered containing VAT (so the system wasn’t adding VAT for you) then upon making the change VAT will be removed from your products' prices. For example, a product that had cost £100 would now cost £83.33 after the change in setting, and would display as such on both your website and in the admin system.

If your prices were entered without VAT (so the system was adding in the VAT for you) then upon making the change VAT will be removed from your products' prices on your website. For example, if you had entered a price for a product of £83.33, and it was therefore being displayed at £100 on your website, it will now cost the customer and be displayed as £83.33.

Do prices contain VAT

Next, choose whether or not the prices you enter contain VAT:

If you choose Yes that uploaded prices do contain VAT the system will not add anything to the price you enter when adding a product or delivery rate, and that price is what your customers will pay.

If you choose No that the prices you enter do not contain VAT then the system will automatically add VAT on top of the prices that you enter for products and delivery rates when displaying the price on your website.

Using the default VAT rate

The 'Use the default VAT rate for my location' setting determines if you want to use the default VAT rate for the location of your account. If you do want to use the default choose Yes. If you don't want to use the default choose No, and enter the VAT rate percentage you want to use in the box that appears:

Please note!

Changing your VAT rate will change the prices of your products.

Displaying prices on your website including/excluding VAT

If you sell to trade customers or other customers who are used to seeing prices without VAT, you can change settings within your account so that the prices on your website are shown without VAT until the customer reaches the checkout page.

On your VAT settings page there are two settings which involve displaying prices with or without VAT.

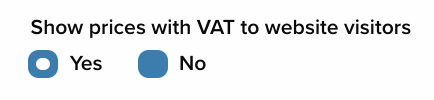

The first setting is ‘Show prices with VAT to website visitors’:

This setting determines if VAT is always shown to all of your website visitors or if it is only shown at checkout. Choose Yes if you want your prices to include VAT wherever they are shown. Choose No if you only want VAT to be shown to the customer at checkout.

The second setting is ‘Show prices with VAT to trade customers logged in’:

This setting will apply to trade account holders who are logged into their account. Choose Yes if you want trade customers to see prices including VAT wherever they are shown. Choose No if you only want VAT to be shown to trade customers at checkout.

Adding an inc/exc VAT note

By default, your ShopWired theme does not include an inc VAT or exc VAT note (in accordance with the setting you have selected) on product prices.

This can be added by making changes to your theme’s code in the page editor.

Displaying both an inclusive and exclusive of VAT price

If you want to display both the inclusive and exclusive VAT price for your products click here to learn how to do this.

Charging the full VAT equivalent price in non-VAT zones

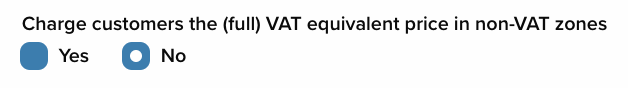

Use this setting to determine if customers who choose delivery to a non-VAT zone should still be charged the full VAT equivalent price:

If you select Yes customers in non-VAT zones will be charged the VAT equivalent price, and if you select No the customer will be charged the price of the product excluding VAT.

Google feed and VAT

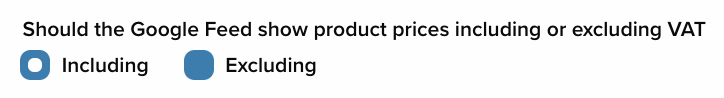

Use this setting to determine is products should be sent to the Google feed including or excluding VAT:

By default, the prices of your products on the Google feed will be displayed including VAT. However, if you display prices on your website excluding VAT (or excluding and including VAT with the excluding VAT price more prominent) then you should submit prices for your products excluding VAT to the Google feed.

To do this change this setting to Excluding.

Once you have finished configuring your VAT settings select save changes.